***EDITOR'S NOTE: Originally, this was supposed to be a short, direct post about why you shouldn't pay a financial advisor. However, it became much more detailed (and informative) than planned, and exploded in length. If you just want to see the plan, I'll make another attempt soon. If, however, you want to learn a great deal more, read on!***

Recently, I've had a number of family and friends ask me questions about personal finance and investing. They ask partly because my day job is in finance, but partly because of how frequently I talk about it. Instead of trying to improvise my thoughts every time, I thought it might be useful to put them in writing. I'll give a sort of primer on some of the more common options that you might have heard about, then talk about how I would allocate money for investment based on some criteria that I'll lay out as well. How do you know that this information is any good? The strongest endorsement I can give to the following investing information is this:

This is the data I've used to invest my own money.

Okay, here we go.

Savings Accounts

Let's start with a situation that many are faced with: You have some money that you'd like to grow, we'll say $100, but the savings accounts at your bank are offering a measly 0.01%. That means that if you put your $100 in this savings account from Chase on January 1st, you'll have $100.01 on December 31st. Yep, you made 1 penny. Brutal. In fact, if you left it in there for 10 full years, you'd have $100.10. It would take 6,932 years to double that money to $200.

The upside is that this is (essentially) risk-free. The downside is that inflation will make your $200 worth nothing. Fortunately, we can do better without materially increasing the risk. Before we continue, though, here's a table to organize the numbers. We'll add to this table as we explore more investment options:

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

Online Savings

Indeed, we can do much better. This savings account from Ally Bank pays 0.99%. After 1 year, your $100 would be worth $100.99, and in 10 years would be worth $110.35. You'll have $200 just after the 70 year mark- a significant improvement. And it's still insured by the U.S. Government

The drawback compared to the Chase account is that Ally is only available online, so no branches for walk-in service. You can still move the money quite easily between your other (regular) bank accounts online, so this isn't too much of a minus. This is about as good as you're going to get for a fully liquid (get your money at any time with no penalty), no-risk investment. At the time of writing this, U.S. inflation is 0.8%, so this account will at least keep your money from losing value over time. Here's our updated table:

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

| Ally Online Savings | 0.99% | $100.00 | $100.99 | $110.35 | 70 |

Certificates of Deposit

But, if you don't need the money for at least 5-years, you can get 2.25% for a 5-year CD (certificate of deposit) from other online banks like Barclays. You'll have $102.25 at the end of year 1, $111.77 at the end of the 5-year term, then $124.92 at the end of year 10 if you put that into another 5-year CD at the end of year 5. You'll have your $200 in year 32, and are well-covered against current inflation. The downside is that if you remove the money before the end of the 5-year term, you will have to pay penalties. In the case of the linked Barclays account, the penalty is 180 days of interest. Not a huge amount, but certainly enough to eat into your investment returns. However, FDIC insurance makes this virtually risk-free.

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

| Ally Online Savings | 0.99% | $100.00 | $100.99 | $110.35 | 70 |

| Barclays 5-yr C.D. | 2.25% | $100.00 | $102.25 | $124.92 | 32 |

Bonds

So those are the "risk-free" bets, but that's not why you're here. You're looking for a better return, like stocks and bonds. Some people might mention real-estate investing as a place to look for a better return, but I don't like the risk profile, the maintenance portion, and its illiquid (much harder to buy and sell) nature.

Since we're moving from less risky to more, I'll move next to:

Bonds.

A bond, also referred to as a "fixed-income security", is a loan from an investor to another entity (could be a company, a city, or a government) that has a fixed interest rate that is returned over a fixed period of time.

The details behind bonds can be quite complicated, so if you're looking to become an expert, which I certainly am not, a good place to start is Investopedia's Bond Tutorial. An example of a common, liquid bond is the United States 10 year Treasury Note. The current interest rate (also called the coupon rate) is 2.00%. When you buy one of these bonds directly from the government, say a $100 bond, you are going to get that 2% each year, for 10 years, and then get your $100 back at the end of that 10 years.

This means that you're going to get $2.00 per year, then the $100 at the end. So at the end of 10 years, you'll have $120. Now, since we're assuming that each dollar earned on investments gets reinvested (which you'd better do, to harness the power of compounding interest), the 2% growth gives you $121.90 at the end of year 10, and $200 will come in year 36.

You can actually log on to Treasury Direct, open an account, and buy these bonds directly. However, those who have been paying attention will notice that this particular bond is actually yielding a worse return than the FDIC-insured 5-yr CD from earlier. (How can the banks make money with a higher rate? Well, they take the money from your locked in CD and loan it out at rates from 3% to over 10% for mortgages, business loans, etc.) In fact, even the U.S. 30 year bond is only paying 2.56%- incredibly low for being locked in that long. These interest rates rise and fall with the interest rates that are set by the Federal Reserve. The incredibly low bank rate currently set by the Fed keeps the return low on bonds, but it also allows for the record-low mortgage rates we enjoy.

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

| Ally Online Savings | 0.99% | $100.00 | $100.99 | $110.35 | 70 |

| Barclays 5-yr C.D. | 2.25% | $100.00 | $102.25 | $124.92 | 32 |

| U.S. 10-yr Bond | 2.00% | $100.00 | $102.00 | $121.90 | 36 |

Municipal Bonds

Take note that U.S. Bonds are relatively risk-free; as long as the U.S. is able to borrow money and pay its debts, the bonds will continue to yield return.

However, we now will travel into the higher return area of investing, so let's be 100% clear here:

Everything from here on out is risky. There is a very real chance that you could lose money over some period of time.

I'll do my best to accurately profile the risk with each subsequent investment, but I just want everyone to be clear. Now, there are obviously a lot of other bond options besides just the U.S. Government, most of which pay more than the U.S. Government. One popular option is what is called a "municipal bond" or "muni". These are issued by local governments (like States and Cities) to fund projects and initiatives. These can yield a better return, but you are taking on a bit more risk. Let's look at an example:

A popular option amongst muni investors is California State Bonds. If you look at the table in the link, you can see that many of these bonds pay 3%-5%, some even as high as 8.75%. Make sure to note, however, the maturity date. While you can buy and sell bonds at any time, longer duration bonds are generally accepted as higher risk, because there is more time for the Fed to change interest rates, which will affect the price of the bond. For simplicity, we'll just assume you're going to hold onto the bond and collect the coupon rate until maturity. (Again, if you're interested in bond pricing and how it affects return, check out the Investopedia Tutorial. I've decided to draw the line on this one and say that bond pricing is outside the scope of this article. Keep in mind, though, that the municipality [city or state] that issued the bond can pay it off early, just like you can pay off your mortgage early. This means you won't get the coupon payments for whatever time period was left until maturity).

Anyhow, let's take a look at one partiular bond, chosen by me, at random. Here's theCALIFORNIA HEALTH FACILITIES FINANCING INSURED NORTHERN CALIFORNIA - 13033L6U6 bond. It's offering a 4% coupon, which is a common return for these type of bonds, and because of the pricing, will yield you that 4% as you'd hope. Here's how that will look for our returns chart:

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

| Ally Online Savings | 0.99% | $100.00 | $100.99 | $110.35 | 70 |

| Barclays 5-yr C.D. | 2.25% | $100.00 | $102.25 | $124.92 | 32 |

| U.S. 10-yr Bond | 2.00% | $100.00 | $102.00 | $121.90 | 36 |

| California Health Facilities Bond | 4.00% | $100.00 | $104.00 | $148.02 | 18 |

Now we're getting into some real returns. The other benefit to most municipal bonds is that the returns are TAX-EXEMPT. For someone in the 30% tax bracket, that means the return on the bond will be 30% better than having just a 4% interest savings account (so effectively this 4% bond becomes a 5.2% return!). The reason these bonds are tax-exempt is because the Federal Government supports public-improvement projects. They want you to invest in improving California's Health Facilities, rather than burying the money in a 4% savings account (if it existed), so they'll waive the taxes for you. Nice! This does mean that not all municipal bonds are tax-exempt, though. The government isn't too concerned about new sports stadiums, for example, so a local bond measure to fund such a project will not be tax-exempt.

So, how's the risk profile look for one single California bond? Well, if California overspends its budget too much (which is a very real possibility, due to the fact that it has done that in the past), they'll quit paying bond holders. Then you get 0% return. The bond market is pretty efficient at properly pricing the risk of non-payment for each bond, so the yield of each particular bond will tell you how risky it is. The higher the yield, the riskier the bond.

Corporate Bonds

The last specific type of bond I'll address here is the Corporate Bond. These are bonds issued by companies, compared with governments and states as we've examined before. The advantage of these is that the returns can be quite high, while the disadvantage is...

Okay, all together now...

They are riskier.

As an example, we'll take a look at a corporate bond issued by a company I'm a bit familiar with (I own some common stock of the company), Exco Resources, a small oil and gas company headquartered in Dallas, TX. In 2014, they issued some bonds to raise money for exploration and land leasing costs. The coupon rate for these bonds is an excellent 7.5%. At the time, oil prices were over $100, and business was looking pretty good, they just needed a bit of cash to keep the ball rolling. Here's a link to a Seeking Alpha article talking about these bonds. 7.5% sounds great right? Here's how the returns look:

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

| Ally Online Savings | 0.99% | $100.00 | $100.99 | $110.35 | 70 |

| Barclays 5-yr C.D. | 2.25% | $100.00 | $102.25 | $124.92 | 32 |

| U.S. 10-yr Bond | 2.00% | $100.00 | $102.00 | $121.90 | 36 |

| California Health Facilities Bond | 4.00% | $100.00 | $104.00 | $148.02 | 18 |

| Exco Corporate Bond | 7.50% | $100.00 | $107.50 | $206.10 | 10 |

Now, since those bonds have been issued, oil prices have dropped into the $40/barrel range and there has been real talk of Exco facing bankruptcy. If that happens, you won't get your coupon payments, AND you won't get your initial investment back, so the money is gone. This is this risk that comes with 7.5% return.

Mutual Funds

Before we continue on in our asset-class list, I'm going to jump sideways for a moment here to address "mutual funds". A mutual fund is simply "an investment program funded by shareholders that trades in diversified holdings and is professionally managed" (thanks, Google). There are hundreds of companies that offer mutual funds, and they charge a small fee (anywhere from 0.05% to 3.00% per year) to take your $100 and spread it across any number of things, like stocks, bonds, real-estate, etc. The convenience to you is that you just have to keep track of one investment yourself, the actual mutual fund. You invest in mutual funds by buying shares of the funds, just as you would in a stock, but the price on a fund only changes once a day (after the markets are closed for the day). We'll take a look at some examples of mutual funds to get a better idea of how they work.

Bond Funds

While it seems that there are nice returns to be had by investing in bonds, there is a decent amount of risk associated with the higher return stuff, and just not that great of return on the more secure stuff. Wouldn't it be nice to be able to invest your $100 across a bunch of bonds to get the exact return and risk that you would like?

That's exactly what a "bond fund" does for you. Instead of having to pick and choose for yourself, a financial company (like Vanguard, or PIMCO, or Charles Schwab) will do the picking, then take whatever amount of money you'd like to invest, pool it with others like you who want to invest in bonds, and buy the bonds for you. As the individual bonds move up in down in price and yield, the bond fund price moves with them. However, with hundreds, sometimes thousands, of bonds in each fund, the risk that one bonds stops paying is hardly noticeable. Now, if the Fed moves interest rates, which affects all bond pricing, the bond fund price can move dramatically. This is one of the risk factors that allows a higher return than something guaranteed, like the CD's and Savings accounts we talked about earlier.

Let's take a look at one of these bond funds. We'll look at the one I like, the "Vanguard Total Bond Market Index Fund". This is a mutual fund that is administered by the company, Vanguard Funds. You can look up the price and characteristics by symbol ("VBTLX"), but here's a link for convenience.

This particular fund has returned 4.72% over the last 10 years, without too much drama (we'll look at a stock fund in a bit that has experienced A LOT of drama, and caused investors large amounts of stress). In fact, Vanguard advertises a 2 rating out of 5 (1 = very low risk, 5 = very high risk) for riskiness, which is nice and low for moderately worry-free investing.

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

| Ally Online Savings | 0.99% | $100.00 | $100.99 | $110.35 | 70 |

| Barclays 5-yr C.D. | 2.25% | $100.00 | $102.25 | $124.92 | 32 |

| U.S. 10-yr Bond | 2.00% | $100.00 | $102.00 | $121.90 | 36 |

| California Health Facilities Bond | 4.00% | $100.00 | $104.00 | $148.02 | 18 |

| Exco Corporate Bond | 7.50% | $100.00 | $107.50 | $206.10 | 10 |

| Vanguard Total Bond Fund | 4.72% | $100.00 | $104.72 | $158.60 | 16 |

To show how steady the returns on this have been (low risk = [usually] steady), here's a chart from Vanguard, showing how your investment of $10,000 would have grown over last 10 years. Obviously, divide the numbers on the left by 100 to mirror our $100 investment example:

As you might expect, this low risk profile comes from the fact that there are currently 7,120 bonds in this fund, and 70% are U.S. Government bonds. The other 30% are corporate. As you might expect, the more corporate and long-term bonds that are in the fund, the higher the return, and the higher the risk.

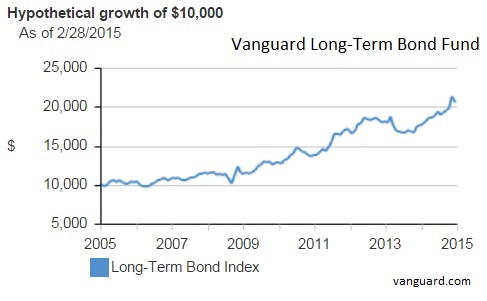

To show an example of that, here's another Vanguard bond fund called the Vanguard Long-Term Bond Index Fund, symbol "VBLTX".

**Very quickly, here, I'm using Vanguard funds as examples because they have a history of being solid, low-cost, and customer-friendly. The cost of their funds can be as much as 90% LOWER than comparable funds with other companies. So if it seems like I'm biased towards Vanguard, it's because I am, and I recommend that you use them as well.**

This Long-Term Fund is a 3 out of 5 on Vanguard's risk scale. Why? Well, this fund invests in 1,912 (fewer than the prevous fund's 7,120) separate bonds, with 60% being corporate bonds, and 40% being government. A riskier blend, indeed.

As you would expect with higher risk, the returns have been better over the last 10 years:

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

| Ally Online Savings | 0.99% | $100.00 | $100.99 | $110.35 | 70 |

| Barclays 5-yr C.D. | 2.25% | $100.00 | $102.25 | $124.92 | 32 |

| U.S. 10-yr Bond | 2.00% | $100.00 | $102.00 | $121.90 | 36 |

| California Health Facilities Bond | 4.00% | $100.00 | $104.00 | $148.02 | 18 |

| Exco Corporate Bond | 7.50% | $100.00 | $107.50 | $206.10 | 10 |

| Vanguard Total Bond Fund | 4.72% | $100.00 | $104.72 | $158.60 | 16 |

| Vanguard Long-Term Bond Fund | 7.36% | $100.00 | $107.36 | $203.43 | 10 |

Notice the return on this is nearly as good as our sketchy Exco Resources corporate bond from earlier, but the risk is much lower. However, it's been a bumpier ride than the Total Bond Fund, shown here (notice the significant dip in 2013):

I'm happy with that coverage for bonds, so let's move on to the big time:

Stocks

So we've made it to the riskiest of assets: single stocks of public companies. There are fortunes to be made and lost trading individual stocks, and you've got a 50-50 shot in the short term on any given trade, because in the short-term, anything can happen. There exist mountains of research on stocks and probabilities, along with as just as many opinions on said research. If you're into it, dig in; I'm not interested in going there, so I'm going to continue to give my own opinion.

With over 100,000 publicly traded companies in the world, we could probably come up with an example to fit any theory, but we'll look at a couple that I've chosen because of some representative characteristic.

Let's start with a popular, volatile stock: Netflix. Here's a 10-year performance chart:

Those price swings are up 1000% (OMG I'm so rich!!) and down 80% (OMG why didn't I cash out!?!?). If you could take the heat, it certainly would have worked out for you, but there would be some serious drama. Not to mention, there's a chance it could head right back down tomorrow.

Let's look at one that hasn't worked out so well in the last 10 years: Citigroup. Here's a 10-year performance chart:

Yep, that thing sold off 90% in the financial crisis and hasn't come anywhere close to being back. Ouch.

And there are variations all in between. In general, though, stocks are well-regarded as high-risk, high-reward investments. Surely, however, there must be a way to get some exposure to stocks without taking on the extreme risk of single stocks? Of course, we'll look to mutual funds that hold stocks, just like we looked at mutual funds that hold bonds. We'll toss our two extreme examples in the chart for fun anyhow.

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

| Ally Online Savings | 0.99% | $100.00 | $100.99 | $110.35 | 70 |

| Barclays 5-yr C.D. | 2.25% | $100.00 | $102.25 | $124.92 | 32 |

| U.S. 10-yr Bond | 2.00% | $100.00 | $102.00 | $121.90 | 36 |

| California Health Facilities Bond | 4.00% | $100.00 | $104.00 | $148.02 | 18 |

| Exco Corporate Bond | 7.50% | $100.00 | $107.50 | $206.10 | 10 |

| Vanguard Total Bond Fund | 4.72% | $100.00 | $104.72 | $158.60 | 16 |

| Vanguard Long-Term Bond Fund | 7.36% | $100.00 | $107.36 | $203.43 | 10 |

| NETFLIX Stock (from 3/2005) | 47.2% | $100.00 | $304.72 | $4,776.15 | 0.32 |

| Citigroup Stock (from 3/2005) | -19.8% | $100.00 | $107.14 | $11.33 | ? |

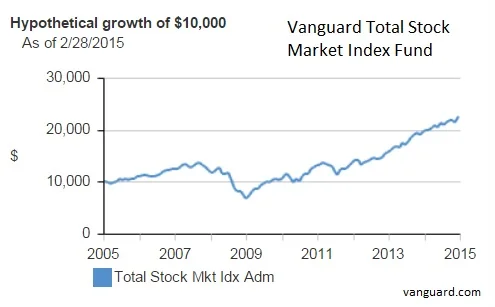

Stock Funds

I don't advocate buying single stocks as an investment strategy at all, for all the reasons we've seen. However, there must be a way to enjoy a good return with just a bit more risk, right? Absolutely: stock mutual funds. The one I like the best is, surprise, Vanguard's Total Stock Market Index Fund (symbol "VTSAX"). This is a mutual fund that holds 3,798 U.S. stocks, weighted in such a way as to price just like an index. This last bit is important, so I'll explain.

An "Index Fund" is a type of mutual fund that invests money according to a certain formula. A Dow-Jones Index Fund, for example, will just invest in the 30 stocks that make up the Dow Jones Industrial Average, and it will invest in the same proportions as the Dow Index. That way, if the Dow is up 0.37% on a given day, the Dow "Index Fund" will be up that exact same 0.37%. There are funds that mimic all sorts of indices: the S&P500, the NASDAQ Top 100, S&P 500 Health Care (this will be made up of hospitals, drug companies, etc), NYSE Technology, etc, etc. The point of these funds is that there isn't some fund manager deciding what and when to buy and sell in hopes of beating the general market; they will perform exactly as they are designed, and normally are much lower cost than the actively- managed funds. The Vanguard Total Stock Market Index Fund charges just 0.05% per year, compared with the normal 1%-3% of other mutual funds.

While that extra 0.95%-2.95% may not sound like much, it is. Check out the table below- it compares the growth of $10,000 over 10 years in 2 funds. Fund A costs 0.05% per year, while Fund B costs 1.55% per year. We'll assume they both return 7% BEFORE costs. Look what happens.

| Year | Fund A(7% return, 0.05% fee) | Fund B(7% return, 1.55% fee) |

|---|---|---|

| 0 | $10,000 | $10,000 |

| 1 | $10,695 | $10,545 |

| 2 | $11,438 | $11,119 |

| 3 | $12,233 | $11,725 |

| 4 | $13,083 | $12,364 |

| 5 | $13,992 | $13,038 |

| ... | ... | ... |

| 10 | $19,579 | $17,000 |

| ... | ... | ... |

| 20 | $38,336 | $28,902 |

| ... | ... | ... |

| 30 | $75,062 | $49,135 |

So after just 10 years, the expensive "Fund B" has returned an excellent 70%! But wait, the low-cost "Fund A" has returned an even better 95%! That's an additional 25% on your initial investment. So while that 1.5% extra may not seem like a lot, it is. In fact, if you draw it out to 20 and 30 years (the amount of time you might be invested before retirement), you can see the difference EXPLODE! And, that's being generous to the actively-managed, expensive "Fund B". There are practically 0 actively managed funds that are able to even match the general market's performance over a 10-year run. So in reality, the difference would most likely be much greater.

Okay, back to our Vanguard Total Stock Market Index Fund.

As we'd hope with taking on the additional risk of investing in stocks, we've also gained return: the 10-year annual return is 8.47%. But as we've learned previously, these high-return assets can be a bit of a bumpy ride. Vanguard considers this a 4 out 5 on the risk/reward scale. To wit, here's what the last 10 years have looked like:

While it may look minimized because of the last 6 years of upward movement, this fund, along with the stock market in general, lost 55% of its value from the peak in late 2007 to the valley in early 2009. The movement was so extreme that it heralded the coming of the "Great Recession" as it's called now. In fact, the losses were so great, and the discomfort so unbearable, that many people pulled their money out of the market in 2009 and have yet to reinvest it. It's an easy thing to say now how that was not a good idea, but at the time, it seemed that the market could continue down to zero.

Note also that it took nearly 5 and a half years for the market to get back to its October 2007 levels. As volatile as the stock market is, this exact situation could absolutely happen again, so as common investing advice says (and I agree with it this time), it's not recommended to have money that you may need to rely on to live, in the stock market.

Back to the happy side of investing in stocks- if you don't need the money for awhile, there is no better place to earn than in a low-cost, U.S.-based index fund. You'll find this advice from esteemed investors such as Warren Buffet, Charlie Munger, and John Bogle. I've tried many different strategies myself, and I've finally settled on this particular one as well. Here's our updated chart:

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

| Ally Online Savings | 0.99% | $100.00 | $100.99 | $110.35 | 70 |

| Barclays 5-yr C.D. | 2.25% | $100.00 | $102.25 | $124.92 | 32 |

| U.S. 10-yr Bond | 2.00% | $100.00 | $102.00 | $121.90 | 36 |

| California Health Facilities Bond | 4.00% | $100.00 | $104.00 | $148.02 | 18 |

| Exco Corporate Bond | 7.50% | $100.00 | $107.50 | $206.10 | 10 |

| Vanguard Total Bond Fund | 4.72% | $100.00 | $104.72 | $158.60 | 16 |

| Vanguard Long-Term Bond Fund | 7.36% | $100.00 | $107.36 | $203.43 | 10 |

| NETFLIX Stock (from 3/2005) | 47.2% | $100.00 | $304.72 | $4,776.15 | 0.32 |

| Citigroup Stock (from 3/2005) | -19.8% | $100.00 | $107.14 | $11.33 | ? |

| Vanguard Total Stock Market Fund | 8.47% | $100.00 | $108.47 | $225.47 | 9 |

Some may have noticed that I said "U.S.-based" when I recommended how to invest in stocks. That will lead me into our last, and probably most controversial, section:

International Stocks

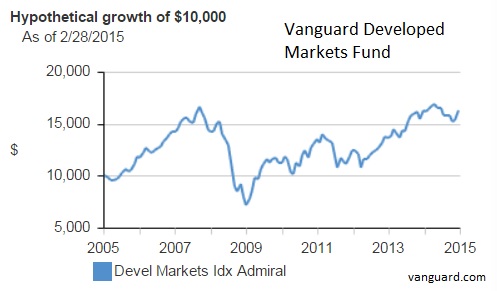

I don't like 'em. I've tried to make them part of my own portfolio for many years, but I'm over and done with it. Pretty much every single piece of investing advice will say to have some international exposure; this includes all the experts in finance and "modern portfolio theory".

It's just as easy to buy an International Stock Index fund, like Vanguard's Developed Markets Fund (symbol "VTMGX"). This fund contains 1,406 stocks of international companies spread across Europe, Asia, and Australia. Now, this is a "Developed Markets" fund, so think England, France, Japan, and Australia. When you hear "Emerging Markets", think Russia, Brazil, India, and China. As you would guess, the Developed Markets are considered less risky, but Vanguard still places the Developed Markets Fund at a 5 out 5 on the risk/reward scale.

So, with such a high risk, we should get the high reward, right? Well, the Vanguard Developed Market Fund has a 10-year return of 4.51%, not even as high as our 2/5 risk level bond fund. And it still hasn't recovered from the losses of the Great Recession. Here's the performance chart:

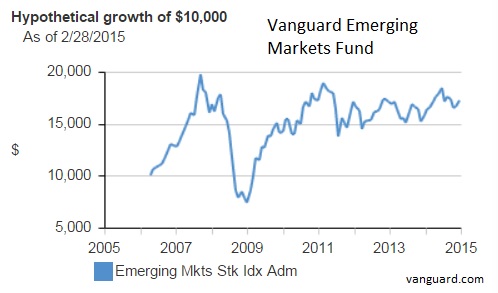

And while the Emerging Markets fund, Vanguard's Emerging Markets Stock Fund (symbol "VEMAX"), hasn't been around 10 years yet, the chart doesn't look any better:

I've spent a great deal of time speaking with my educated foreign connections (from places like China and Bulgaria), trying to figure out why those markets haven't prospered as the U.S. has in the last 5 years. Their answers were the same: corruption and fraud. Many (certainly not all) of these foreign countries and corporations struggle to keep on the straight and narrow. Embezzlement, tax fraud, insurance fraud, and misreporting are all common occurences in some of these places, so unless I become intimately familiar with a foreign company, I won't be continuing any foreign investment. Here's our chart with the Developed Markets added in:

| Annual Return | $$ Invested | $$ After 1 year | $$ After 10 years | Years to Double $$ | |

|---|---|---|---|---|---|

| Chase Savings | 0.01% | $100.00 | $100.01 | $100.10 | 6,932 |

| Ally Online Savings | 0.99% | $100.00 | $100.99 | $110.35 | 70 |

| Barclays 5-yr C.D. | 2.25% | $100.00 | $102.25 | $124.92 | 32 |

| U.S. 10-yr Bond | 2.00% | $100.00 | $102.00 | $121.90 | 36 |

| California Health Facilities Bond | 4.00% | $100.00 | $104.00 | $148.02 | 18 |

| Exco Corporate Bond | 7.50% | $100.00 | $107.50 | $206.10 | 10 |

| Vanguard Total Bond Fund | 4.72% | $100.00 | $104.72 | $158.60 | 16 |

| Vanguard Long-Term Bond Fund | 7.36% | $100.00 | $107.36 | $203.43 | 10 |

| NETFLIX Stock (from 3/2005) | 47.2% | $100.00 | $304.72 | $4,776.15 | 0.32 |

| Citigroup Stock (from 3/2005) | -19.8% | $100.00 | $107.14 | $11.33 | ? |

| Vanguard Total Stock Market Fund | 8.47% | $100.00 | $108.47 | $225.47 | 9 |

| Vanguard Developed Markets Stock Fund | 4.51% | $100.00 | $104.51 | $155.45 | 16 |

I do recognize, though, that the international market could explode upwards starting tomorrow, giving the best returns seen on Earth to date, and I'll really look like a fool.

Such is the way with investing, though. I try to make the best decision possible with the information at hand.

Originally, this was supposed to be a short, direct post about why you shouldn't pay a financial advisor. Because this turned into a monster of a post, I've made another attempt at how the financial advising and wealth management industry is a scam: a DIY to effectively managing your own money.

Thanks for reading, and please leave corrections, advice, insights, and rants in the comments below.